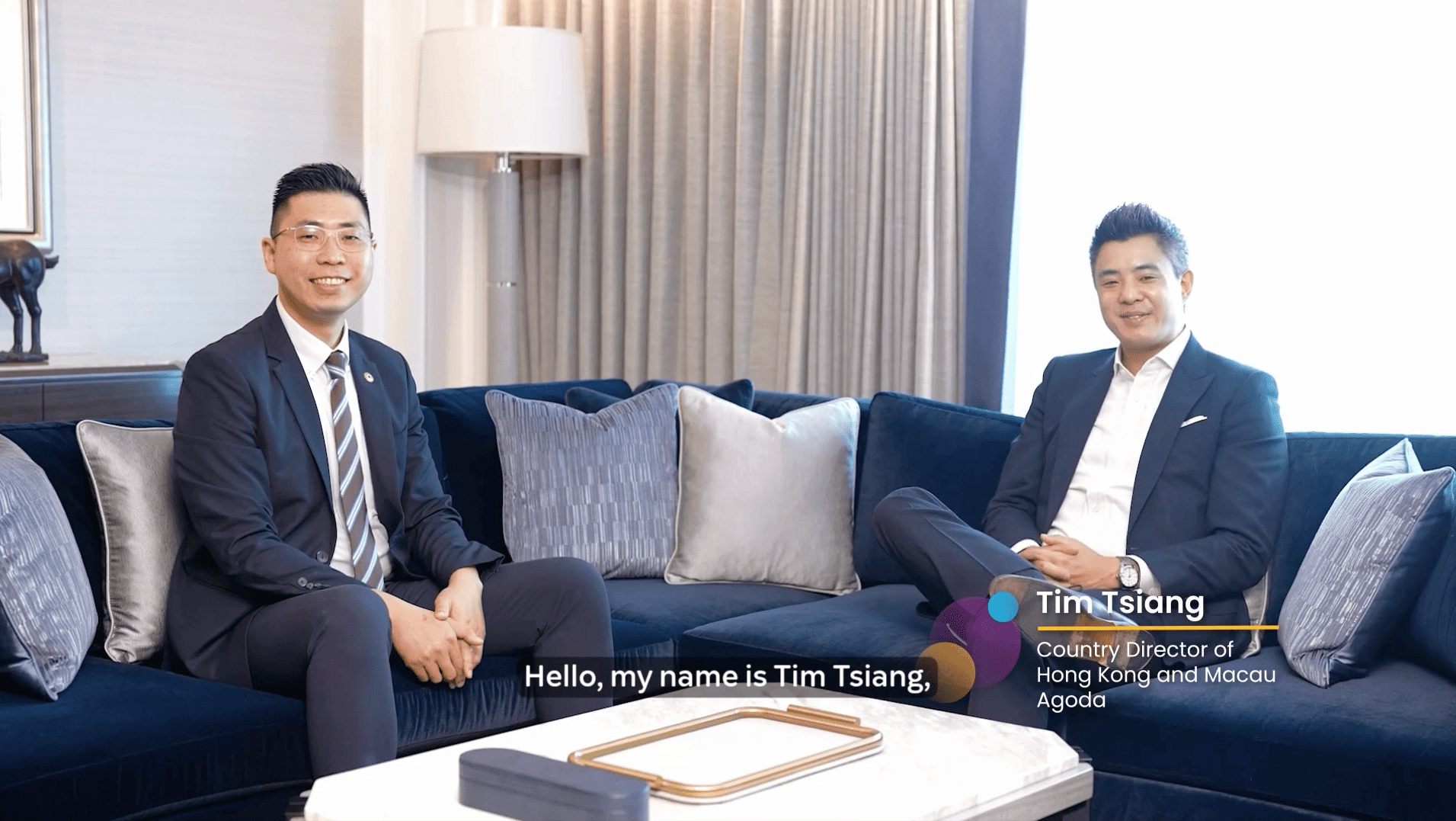

Summary

As of 16 October 2023, for all properties in Israel, excluding those in the city of Eilat, a 17% VAT must be charged on services rendered to Israeli citizens. Agoda has been requested by the Consumer Protection Authority to show the total price including this VAT to customers during the booking process.

The authority would accept a solution based on IP address to determine a traveler’s nationality and apply VAT accordingly. For travelers who book using an Israeli IP address, Agoda will collect the amount including VAT and remit this amount to the property. Upon check-in, the property must make the final decision based on the traveler’s nationality, whether the VAT needs to be refunded or remitted to the government.

What has changed?

Until now, Agoda simply displayed a note on the booking form indicating that VAT might be collected by the property upon check-in based on the traveler’s nationality (Image 1). The law now states that Agoda is responsible to show the full price including VAT for Israeli citizens on all pages. Since determining the traveler’s nationality before the final step is not possible, the traveler’s IP address will serve as an indicator of whether VAT should be applied.

Image 1 – Current note on the website

What has changed for travelers?

If the traveler is booking an Israel-based property from an Israeli IP, an additional VAT will be included in the price shown to the traveler (image 2). We will notify the traveler that they may be eligible for a refund if they are non-Israeli nationals booking from an Israeli IP. The refund will be processed by the property at check-in. It is the responsibility of the traveler to prove that they are holding non-Israeli passport and should present their Agoda booking voucher to the property which displays the VAT that has been charged.

Image 2 – New note for Israeli IPs

If the traveler is booking an Israel-based property from a non-Israeli IP, no VAT will be charged; hence, there is no change (Image 3). We will notify the traveler that they may need to pay an additional 17% VAT if they are Israeli nationals booking from a non-Israeli IP.

Image 3 – New note for non-Israeli IPs

What has changed for properties?

The properties do not have visibility into the traveler’s nationality beforehand, and due to system limitations, they cannot input separate rates for Israeli nationals and non-nationals. Hence, Agoda will need to add the VAT on top of the rates that the properties input.

Currently, the majority of the properties are using the rate load type Sale Inclusive, but the rates being loaded do not include any taxes. Therefore, to make sure that Agoda is legally compliant and that our travelers do not have to pay higher than required taxes, all properties must change their rate load type to Sale Exclusive.

After the properties have updated their rates to Sale Exclusive, Agoda will be able to apply an additional VAT for travelers using Israeli IP addresses. This additional VAT will then be remitted to the properties. Although this IP based approach has been discussed and finalized with the authorities, it will not be fully accurate. There may be two cases where the VAT collected is not in line with the traveler nationality (Image 4, 5). In case an Israeli traveler (based on passport) is booking using a non-Israeli IP, the property must collect an additional VAT upon check-in. In case a non-Israeli traveler (based on passport) has already paid the VAT to Agoda, the property must refund the VAT to the traveler (Image 4, 5). It is the responsibility of the property to remit the VAT to the government when appropriate.

Image 4 – Four scenarios based on traveler nationality & IP address.

Image 5 – Process of VAT collection or refund when the traveler has already paid for the booking to Agoda.

What if the properties fail to make the changes in time?

If the properties are on Sale Inclusive and fail to change their rates to Sale Exclusive, Agoda will break down the rate to show the 17% VAT separately to the travelers using Israeli IP addresses. The property must remit VAT to the government from the rate which was uploaded in YCS for Israeli nationals. For non-Israeli nationals who have been charged VAT, the property must refund the VAT amount which has been charged by Agoda. For Israeli nationals booking through non-Israeli IPs, the property must collect additional VAT and remit this amount to the government.

Image 6 – Agoda will break down the Sale Inclusive rate type to show included VAT for Israeli IPs

FAQs

Israeli citizens must pay a 17% VAT on services at all properties in Israel, except in Eilat.

A 17% VAT is added to the Sale Exclusive rate uploaded by properties on YCS.

It will only affect bookings made after Agoda starts applying VAT to travelers using Israeli IP addresses on the mobile app and Agoda website.

No tax invoice will be issued.

If the traveler doesn’t directly book with Agoda, the property is responsible for collecting the VAT.

Please reach out to our Accommodation Services team via our YCS extranet Need support widget.

If the booking is non-refundable, no VAT refund will be issued, even in the case of a no-show.

Contact us

Still looking for a solution? Contact us via the YCS Need Help Button or other methods.

この記事は役に立ちましたか?

%

%

ご意見をお寄せいただきありがとうございます。